Link: https://www.youtube.com/watch?v=xguam0TKMw8&t=45s&ab_channel=PrinciplesbyRayDalio

- Principle 1: When central banks print money, buy stocks, gold, and commodities. -> The Fed does this by buying more US Treasury Securities (bonds), adding reserves (excess money) to banks, and this excess money can then be loaned out to people (lower interest rate -> then more loans but also higher inflation, hence buying commodities (reducing cash) makes sense)

- Higher interest rates slows down inflation rates, but it also decreases consumer spending (higher mortgage rates, less home ownership, and higher saving rates, more cash in reserves, and also higher loan rates, less loans are taken out) which increases the value of cash, typically leading to selling of stocks and commodities.

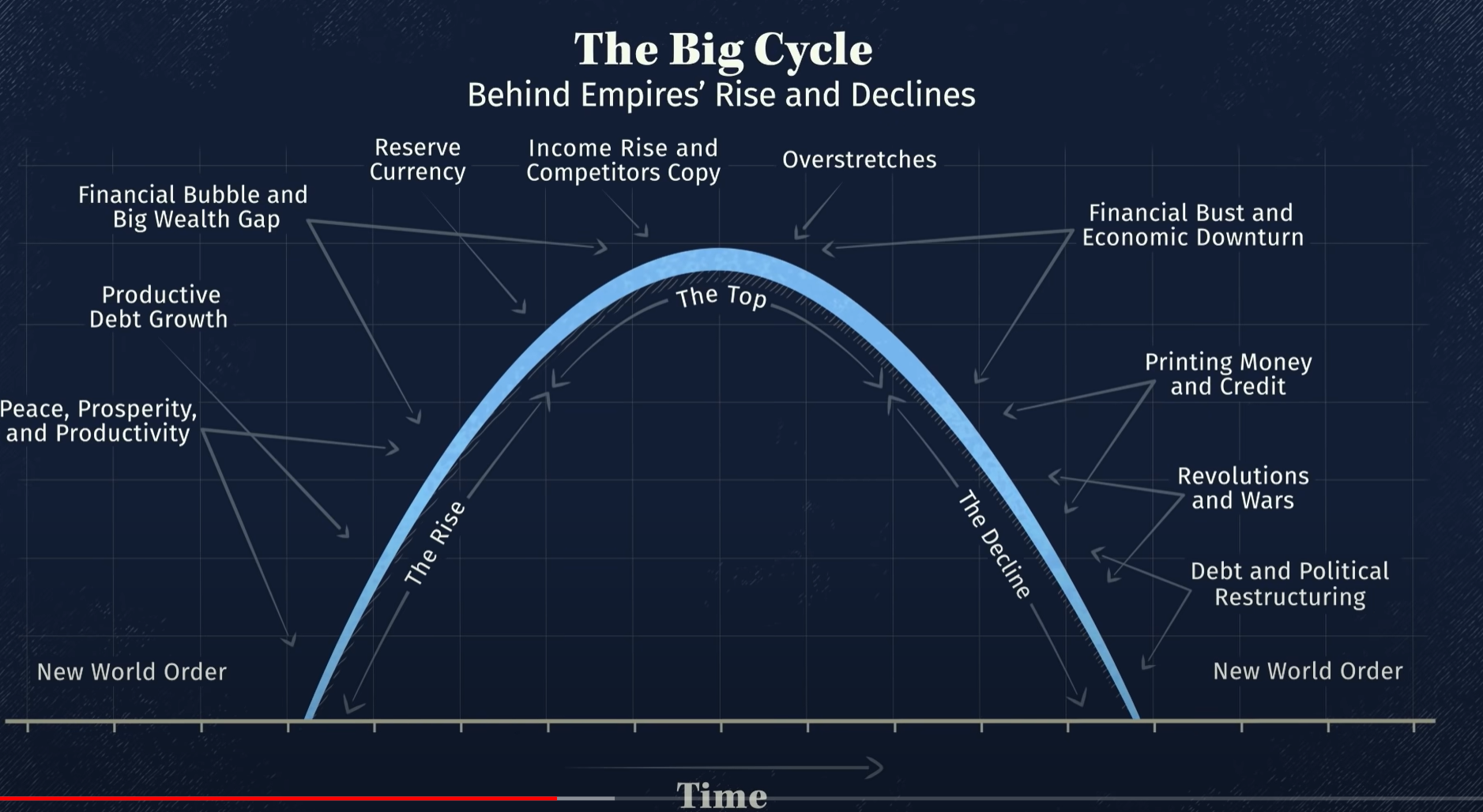

- Every empire (world's most powerful country) starts off with increased education, led by technological advances and military advances, and at its peak power, a big gap between the wealthy and poor forms, which then causes a civil war (blue vs. red), which then leads to international warfare where the second rising power fights and takes over the "world order," changing the "preferred medium of exchange" or common currency the world uses. Right now, it is the United States but China is rising while US is declining. The shift takes around 10-20 years.

- The Rising Stage: Typically starts with a powerful political leader who wins the side of the majority, then is succeeded by more powerful leaders. They establish institutions and systems. Implement strong education. (fun fact: the Dutch invented Capitalism in 1600s) With that, normally comes new technologies. Which leads to: increased competition, then increased economic output, and then increased world trade share. Then they build military strength. This leads to strong income growth (more trading and stuffs), which can be redistributed through a central financial center to education, infrastructure, and R&D. Capitalism helps build this and to continue improvement, bonds/stocks/loans should be readily available to fund entrepreneurs (innovation). With enough trade share, the country's currency becomes so widely accepted that it becomes the preferred medium of exchange. So more countries want to keep the currency, so they buy bonds which makes it the preferred storehold of wealth. Reserve currency: (Dutch guild -> British Pound -> US Dollar ->soon China Yuan??)

- The Top: As the leader, competitor countries start to copy technologies and sell for cheaper. Competitors are also willing to work for less. (Hence, made in china is so much cheaper than made in US, and it happened with the Dutch: The British were willing to work for cheaper than Dutch, leading to rise of British and decline of Dutch) With increased wealth, people work less (quitting jobs) to enjoy leisure. As generations change, the new generation want to work less as they were privileged with wealth. This makes them more vulnerable to competitor countries. (Golden era for Dutch, Victorian era for British, American Dream era for US) Eventually, a large gap in the wealthy and poor begins to form. At a point, borrowing and spending increases too much (which in short term helps economics) but in long term, it increases debts (IOUs) and decreases income. The country borrows too much money from its allies (or empire) and runs out of lenders, eventually stopping the cycle of buy->save->lendout. This leads to the decline in strength of empire.

- The Decline: It begins with the internal conflict of wealthy and poor (red and blue) or with the external conflicts (like US vs. China or opposing political countries). The central bank has too much debt it cannot pay back to the people (typically as bonds; people have bonds and the central bank cannot repay it) leading to sharp decline in the economy. This leads to printing a lot of money and credit. This increases inflation and decreases the value of the currency. This then decreases the living standards for most people, causing even more tension between the poor and wealthy, leading to political extremism (fascism vs. communism). This leads to redistribution of wealth, which can be peaceful (taxing) or violent (civil war, e.g. French revolution, Chinese revolution, Soviet revolution). This internal conflict raises the risk of international warfare as competitive countries start to see it as an opportunity to attack. Hence, the start of an international war which then gives rise to a new WORLD ORDER

- Principle: A Nation's greatest war is with itself